The Math of Market Timing: Why Missing Just a Few Good Days Destroys Returns

Why investors who flee temporary pain often miss permanent gains

Reflections from the Past Week

Market swings can feel scary—especially when every news site seems to have a flashing headline and a breaking-news banner. But here’s some perspective that might help.

Unless you're within 10 years of retirement, there's no reason to stress over daily market movements. Seriously. The best thing you can do? Automate your contributions into a globally-diversified portfolio, take a walk, and pick up a good book—I just started The Night Watchman.

Equity markets are remarkably resilient. In fact, next week I’ll share a brief look at their historical strength that dates back 400 years.

For now, consider using this moment to reassess your personal risk tolerance. Volatility isn’t just noise—it’s a chance to get clearer on your financial temperament.

And if you need a quick dose of wisdom, here’s a short video clip from Warren Buffett that has stuck with me for years.

“You will see things you won’t believe in your lifetime in securities markets. If you can stay objective through that, if you can detach temperamentally from the crowd, you get very rich…and you won’t have to be very bright. It doesn’t take brains, it takes temperament.”

Warren Buffet

The Impact of Missing the Biggest Green Days

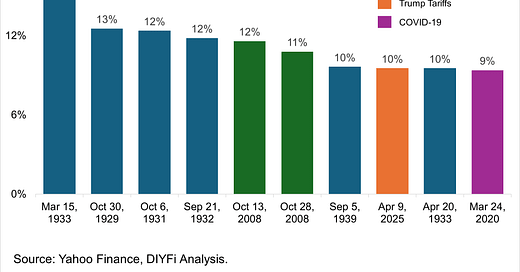

Yesterday marked the 8th largest single-day gain in S&P 500 history. These sharp rebounds often occur during turbulent periods—just like the others shown in the chart below.

That isn’t to say the pain is over. In 2008, markets kept sliding until March 2009. But if you’re not in the market during these rare but powerful upswings, your long-term returns can suffer dramatically.

For example, according to a J.P. Morgan study, if you had invested $10,000 in the S&P 500 in 2004 and stayed fully invested through July 2024, your return would be about 10.5% annually. But if you missed just the 10 best days, your return would shrink to 6.2%. Extend that out to 20? 3.6%.

That’s the cost of trying to time the market.

In periods of volatility, your best move is usually no move at all.¹

Detach yourself temperamentally.

¹ Assuming your contributions are already automated. If they’re not, make that your next move!

okay zen fin daddy