The S&P 500 Has Been Great—But It’s Not Everything

Common advice in the United States is to buy an S&P 500 index fund and let it grow. And if you’ve done that, you’ve been rewarded handsomely—especially over the last 15 years.

The reasoning?

✅ It’s low-cost

✅ It’s performed exceptionally well

✅ It’s diversified

But here’s what most people miss:

The S&P 500 is just half of the global stock market

It excludes smaller U.S. companies

It ignores international companies entirely

Why International is a Must

This is where my inner UChicago econ nerd wants to start talking about maximizing risk-adjusted returns and minimizing uncompensated risks, but I’ll keep it simple. You don’t need fancy terms to see why investing beyond the U.S. is essential.

Single-country risk

Most of us live, work, and earn in the U.S. This means we already have massive exposure to the U.S. economy. If you’re only investing in U.S. stocks, you’re doubling down on that risk.

In 2008, when I was 14, my dad lost his job and spent the next two years unemployed. I was too young to fully grasp it, but I still remember the stress—jobs disappearing, 401(k)s cratering, home prices sinking.

International stocks help de-risk your portfolio by giving you exposure to economies that are doing well when the U.S. is not.

History Proves No Country Stays on Top Forever

Stock market dominance is never permanent. The U.S. might feel unstoppable today, but so did the United Kingdom in 1900.

In 1900, the U.K. made up 25% of the global stock market.

Today? It’s just 4%.

The U.K. didn’t collapse—it just grew slower than other countries over time.

Now apply that to the U.S.:

Today, the U.S. is 65% of global markets.

In 30 years, it might be 40% as other countries grow faster.

The U.S. doesn’t have to collapse for returns to slow—it just needs to take up a smaller share of global capital.

International Stocks Trade Off With the US

The 2008–2024 bull market makes it seem like U.S. stocks always win—but that’s just recency bias. International stocks outperformed in the 1970s and 1980s as well as from 2000 to 2008. Markets go through cycles—you don’t want to be overexposed to just one cycle.

How to Add International Stocks

There are two low-cost ways to do it.

Option 1: One-and-Done ETF

Vanguard Total World Stock ETF (VT) → Holds every stock in the world, including the entire S&P 500.

Option 2: Pairing U.S. & International Funds

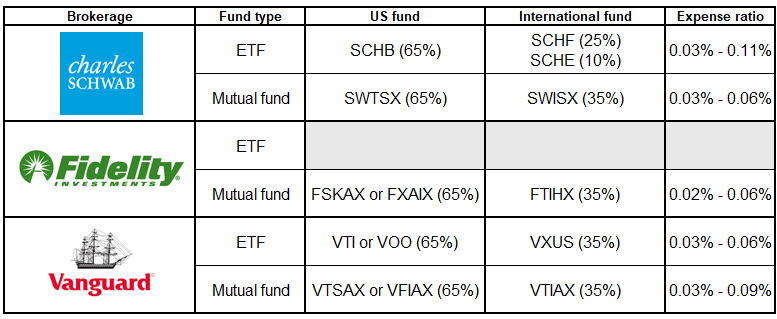

If you’re over-exposed to the U.S. market, don’t sell your U.S. holdings just to rebalance. Instead, add international stocks until you reach your target split. Most investors hold 60-80% U.S. and 20-40% international. I would generally shoot for 65% US and 35% international to mimic global market caps.

Going forward? You can just buy VT at any brokerage and be done.